The global economy is currently in its most fragile period in history. Never before have we experienced such profound geopolitical instability, which is why market uncertainty worldwide is escalating over time, akin to a powder keg waiting for its first spark.

Prominent amidst the current economic and political turbulence is the increasing underlying power of central banks worldwide, with none other than the United States Federal Reserve (commonly known as the Fed) leading the pack. The words of the Fed's chairman carry enough weight to shift global markets, and the Fed's intentions can create or shatter stock market trends. If we view the global financial market as a religion, then the Fed's chairman is its high priest, and his words are its scriptures.

With the power to create reserve currencies worldwide (the US dollar being the default currency used in transactions between two nations), the Fed holds an immense power that few truly understand, the ability to create the money supply that all nations around the world need to hold. However, the Fed's power is not limited to controlling the world's reserve currency supply; its true strength lies in its ability to influence the entire global economy through its monetary policies. Put simply, when the Fed speaks, everyone in the financial world listens.

The operational objectives

Starting in 1977, the United States central bank was granted by Congress to manage "dual mandates" that are extremely crucial in the economy: (1) ensuring stable inflation and (2) keeping the unemployment rate at a minimum. This is actually a very difficult task because the two goals are inherently contradictory; to achieve one goal, the other must be compromised.

When inflation is low, it means that the economy is not vibrant -> companies do not have income -> they cut staff to reduce costs or do not need to hire more staff -> unemployment rises. At this time, to improve the economy, the method that the Fed often uses is to lower interest rates. When interest rates go down -> borrowing costs are low -> individuals and businesses borrow more -> personal consumption and business investment expand -> spending increases -> current income increases -> demand for jobs increases -> inflation rises accordingly.

To ensure the effectiveness and transparency of one of the most important agencies of the country, the Fed is granted the authority to operate completely independently of the government and has the full power to make decisions that the agency deems best for the economic interests of the United States without having to consult third parties. The textbook theory teaches so, but in reality, the Fed has never been a completely independent entity separate from the control of the United States government, as both sides have always worked in complementary ways to push specific economic policies together. The Fed has the authority to operate independently in tasks assigned by Congress, but it is not completely separate from the influence of the government as the theory often preaches. This is most evident in how the Fed handled the 2008-2009 global financial crisis.

Inflation must be tightly controlled at a moderate level to ensure stable and sustainable economic development. Excessive inflation can lead to dangerously adverse effects on the stability of an economy, while too low inflation (or worse, deflation) indicates economic weakness, with the risk of increasing unemployment rates.

A small note for readers: in modern economics, there is a fundamental difference between two schools of thought: "free market policy" and "government's intervention policy". The free market advocates believe that government intervention often yields little good and may leave behind potentially dangerous consequences that could seriously affect long-term stability. While governments may have good intentions, the economy is a complex machine, and deliberately altering the "free" operation of the market can have strong counterproductive effects, potentially leading to systemic changes that diminish the market's efficiency in the long run. Therefore, the best approach is to let the market operate freely, and all issues will be resolved in a "free" and "efficient" manner through the market's inherent operating principles. Renowned economist Milton Friedman was a staunch advocate of the market's independence and integrity, believing that the government's role in the economy should be minimized.

Disagreeing with the naivety of free-market economists, renowned economist John Maynard Keynes advocated for immediate government intervention to prevent crises from spreading and potentially leaving deep economic scars on the market. Keynes argued that when the market operates efficiently, it should be left to operate "freely" as Milton Friedman always desired. However, the government needs to intervene promptly when the economy shows signs of potential impending recession; either intervene timely to minimize the consequences to the maximum extent or do nothing and witness the growing monster over time, eventually shattering the entire economy. Keynes was pragmatic; he did not like sitting idly by when disaster was looming.

I won't delve deeply into this debate as it's an endless black hole, but an interesting point is that the global financial crisis of 2008-2009 caused the laissez-faire policies, once widely embraced within the U.S. inner circles, to yield ground to more interventionist policies from the government. Milton Friedman's ideas had enjoyed widespread political support, but when the 2008-2009 crisis hit, Keynesian ideas began to resurface and become increasingly popular. Milton Friedman had largely prevailed in the battle for a significant period, but it seems now is the age of John Maynard Keynes. Keynesian ideas have returned, and they are stronger than ever. But I'm rambling now; let's get back to the main topic.

Like other central banks, the Federal Reserve has chosen 2% as its target inflation rate, although the reason behind this specific number remains somewhat of a mystery. We only know that 2% is the magical figure that the Fed has chosen as its target. To keep inflation around the 2% mark, the main tool the Fed has always used is interest rate control. By controlling the cost of borrowing money, the Fed believes they can influence the behavior of businesses and consumers in the economy.

When inflation is too high, the Fed understands that the economy is overheating, and the task at hand is to cool down overly enthusiastic activities. By increasing interest rates, the Fed directly raises the cost of borrowing that individuals and entities in the economy can undertake -> reducing the overall demand for money in the economy because the cost has now risen higher -> reducing economic activities -> reducing inflation. Conversely, the same holds true when the economy is sluggish and inflation is below the 2% target.

However, once an economic trend is established, it creates a self-reinforcing loop and often leads to unintended consequences. No one understands this better than the Fed. If the economy is overheating and inflation is above target, the Fed may decide to raise interest rates to bring inflation back to the target level. This can have negative effects as companies become less enthusiastic about borrowing to increase investment and expand their businesses, and individuals lose interest in borrowing for consumption. Businesses may struggle, leading to layoffs to optimize operating costs. Economic downturns always result in increased unemployment - something the Fed never desires. Therefore, every time a policy is implemented, Fed officials always have to debate extensively because they fear that the economy may overreact and create unpredictable chain reactions.

Before the global financial crisis of 2008-2009, interest rate control was the common tool that the Fed used to manage the pace of economic growth, and it worked quite effectively. However, when the global financial crisis occurred, suddenly this tool lost its significant impact as it no longer had the ability to affect overall demand in the economy. The Fed had to lower interest rates to near 0% to stimulate demand, but surprisingly, nothing happened. The fear among the public was too great, and near-zero interest rates simply could not soothe the immense anxiety within the U.S. economy. The Fed had to come up with other tools to address the credit crisis that Wall Street had created, and as a line from the iconic Mission Impossible movie series goes, "Desperate times call for desperate measures".

If the entire economy is thirsty for cash and doesn't know where to find it, the Fed steps in as the savior and bestows grace upon them. When interest rate control tools become ineffective, the Fed must come up with other methods to influence an economy teetering on the brink of darkness. Leveraging its unparalleled imagination, the Fed begins to add new tools to its management toolbox, including quantitative easing or forward guidance. All aimed at controlling the enormous credit crisis that Wall Street had recklessly and indiscriminately lent into.

Although born out of desperate economic circumstances, quantitative easing (QE) has gradually become the Fed's preferred tool to address the 2008-2009 crisis, whose aftermath still lingers globally until the advent of the Covid pandemic. Once again, the Fed finds itself in extreme agony in the quest to find a way out of the seemingly endless crisis.

Who will save us?

When the bubble burst in 2009, all financial institutions on Wall Street plunged into a severe crisis. Two major Wall Street banks, Bear Stearns and Lehman Brothers, went bankrupt, while others teetered on the edge. Consumer spending plummeted, people panicked, and savings accounts were wiped out. The stock market plummeted uncontrollably, unleashing one of the worst economic crises in history. The credit monster that Wall Street had been feeding daily finally exploded in its face. The crisis storm spread from the United States to Europe and Asia, leaving everyone unwittingly caught in one of the most severe financial crises in human history.

As the crisis reached its peak and the Fed's near-zero interest rates became ineffective, the Fed had to rescue the economy by creating a massive amount of money and injecting it into the economy to address the liquidity problems of banks deemed too big to fail. The Fed purchased a vast amount of toxic assets from major banks as well as government bonds, acting as the lender of last resort to a slew of cash-strapped institutions, thereby increasing the U.S. government's debt to trillions of dollars. Quantitative easing, a new tool in the Fed's management toolbox, became the new normal in the post-2009 world. Cheap money became a commodity not only in the U.S. but also in European countries, Japan, and countries severely affected by the financial crisis.

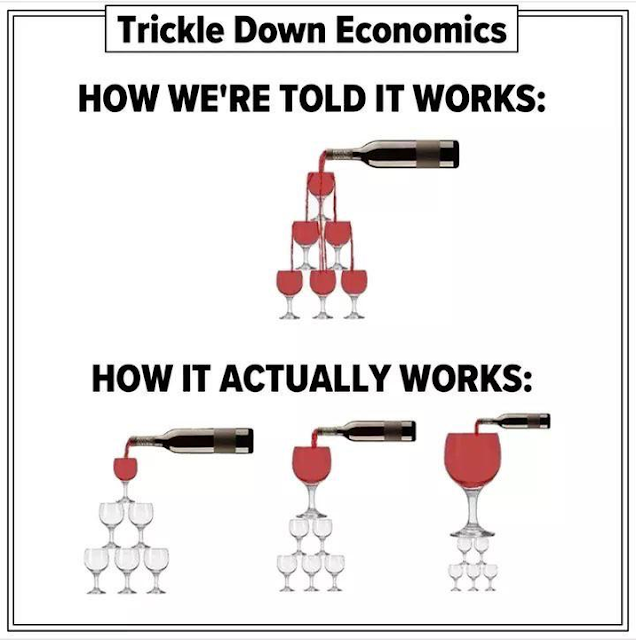

When no one else could save the greedy financial industry, the Fed would extend its hand, and it would be the workers who paid the highest price in the devastating recession they never caused. The Fed's rationale was based on a fairly popular economic theory at the time (but later proven ineffective, although it still had considerable support at the time) called trickle-down economics. Simply put, trickle-down economics assumes that by making the wealthy even wealthier, this wealth will gradually trickle down through various layers of the economy, eventually benefiting the lowest-income workers. By making the top tier richer, wealth will trickle down to all layers of the market economy.

Suppose we divide the economy into different tiers based entirely on income, with the elite at the top and low-income workers at the bottom. In that case, the trickle-down economic theory posits that the money the elite possess will gradually trickle down through lower economic tiers via increased overall consumption and investment in the economy. As lower tiers experience increased income, their levels of consumption and investment in the economy will also increase, leading to higher income levels for lower tiers as well. This positive loop continues, and the money gradually trickles down to the very bottom tier of the economy. Readers can imagine the tiered fountain at weddings to visualize how this theory operates.

While this theory is relatively straightforward, there was still no empirical data to verify its accuracy at the time. The Fed wholeheartedly used quantitative easing to address the crisis, with trickle-down economics serving as the theoretical basis for its actions. The Fed naively believed that by making the already wealthy even wealthier through continuous injection of money into the capital market, somehow this money would transfer to the real economy (the consumer economy) and thereby revive the fragile economy after the crisis. Quantitative easing directly enriches the elite because the Fed injects newly printed money into the economy through the purchase of assets and government bonds, who do you think holds these assets the most? None other than the individuals and organizations that were already wealthy. Low-income laborers have no access to this new money because they do not own any assets. However, according to trickle-down economic theory, the Fed believes that sooner or later, this money will reach them, and from there, it will increase the pace of spending and investment, thus pulling the economy out of the crisis.

The Fed continuously employed Quantitative Easing for a very long period after 2009, believing it was the best course of action for the economy still reeling from the crisis. What the Fed didn't anticipate was the prolonged period of low inflation (indicating a weak economy), stagnant incomes for much of the workforce, and the economy remains reliant on life support such that if the Fed stopped spending, everything could catastrophically implode in an instant. The only thing that changed was the skyrocketing value of various assets like real estate and stocks, benefiting investors and the elite the most from the Quantitative Easing spree, while those without any assets were left further behind, exacerbating inequality over time.

The Fed seemed to have enough data to believe that besides boosting asset values for the owners, Quantitative Easing had very little, if not entirely negligible, effect on the real economy; information on inflation and employment wasn't particularly rosy, but the Fed knew it couldn't halt. It had created an economic environment where people had become accustomed to easy access to cheap money, and the mere cessation of the Fed's capital injection would precipitate a new crisis, a scenario the Fed couldn't afford to let happen again. Thus, the Fed turned a blind eye and continued pumping money into the economy steadily since 2009, keeping interest rates near 0% for an extended period, until the Covid pandemic struck and brought about permanent changes in the market.

In this period, it would be a significant oversight not to mention another tool frequently used by the Fed to stabilize the market - forward guidance. The Fed understands very well that its every move can have a chain reaction on the economy. Therefore, as the most powerful central bank in the world, everyone must listen to and evaluate the Fed's future policies and reflect their assessments on the market. The market always reacts excessively to any changes in the Fed's policies, especially unexpected ones. In simple terms, the market detests being blindsided by the Fed and is always cautious, eagerly anticipating information before each formal announcement. To increase stability in the market, the Fed leaks its intentions to the media through rumors before making official announcements, and the media loves this type of information because it's precisely what investors are seeking. Although the Fed always denies its involvement with these leaks, investors understand that they can fully trust that the Fed will do as they say they will because stability is precisely what the Fed aims for.

The Fed knows that the market easily reacts like a herd without its senses, and therefore, stability can only come if everyone believes that the Fed will do exactly as they say they will. Forward guidance is the tool the Fed uses to increase stability in the market, telling investors worldwide, "You can trust that we will keep our word". Nothing increases stability in the global market more than confidence in the consistency between the words and actions of the most powerful authority in the financial world. If the Fed has said they will do something, global investors can trust that the Fed will definitely do it, and if the Fed unexpectedly changes its mind, they also believe that the Fed will inform the world about this change.

The Fed has done everything to save the economy with unprecedented monetary policies in history; however, the Fed has also had to pay a very high price, or more accurately, the majority of Americans have had to bear significant consequences - they stood still while the elite became richer. Inequality has never been greater in the history of the United States, and latent class conflicts are waiting to erupt like a slow-burning bomb.

The cost of cheap money

The policies of creating money out of thin air by the Fed to cope with crises have left serious repercussions in the economy, but their effectiveness remains a huge question mark. The Fed has created an environment where "cheap money" is a new normal, so it's not surprising that those who can easily access it don't value the currency but simply see them as chips to gamble in the world's largest casino. The newly injected money into the market is mainly used to inflate asset values through a frenzy of buying by the elite, who are getting richer day by day from free money from the Fed, while the asset-less class increasingly has to accept lower-paying jobs and job stability is no longer guaranteed. The Fed has turned a blind eye to the fact that the trickle-down economic theory, through a series of market data, has been proven to be ineffective. But the Fed knows that it can't stop printing money because only the new money pumped through annual Quantitative Easing packages can save an economy that is too weak and doesn't know where to seek growth momentum.

Although constantly affirming to the media that all the policies the Fed is pursuing aim to promote economic growth after a severe global recession, the most prominent thing in the years of money printing is the widening wealth gap over time, which is at a record high in history. The world has never been richer, but we are also the most indebted generation in human history. All the wealth the world is enjoying today is built on a mountain of massive debt, and we have the right to question whether this can continue indefinitely without consequences. Modern Monetary Theory argues that we don't really need to worry about national debt because governments can always print new money to pay off old debts. The author neither denies nor agrees with this statement; in fact, only time can answer whether the statement is the truth of the world or just a new illusion of academic economics. Time will tell.

The injection of new money into the economy will not be able to revive growth if it is not spent and utilized in the consumer economy. In reality, the money mostly circulates within the capital economy, which is the playground of the elite in asset trading. The Fed is reluctant to believe that if they are serious about addressing the economic growth puzzle, they must find ways to put the money into the hands of the people to encourage spending rather than continuously enriching the already wealthy class. The Covid pandemic has forced the Fed to implement Quantitative Easing in a completely new way, where new money is directly transferred to people's accounts.

The author understands that direct cash transfers to the people are a temporary solution to address the sudden COVID crisis, and we should not expect free money to become a new normal in the economy. However, what the author wants to emphasize here is the effectiveness of using Quantitative Easing. For a long time, the Fed struggled to get the newly printed money into the hands of the middle or lower-income classes, who tend to spend more than the elite. The Fed expected the trickle-down economic theory to work, but the reality was different. Perhaps the lesson here is that the simplest answer always turns out to be the most accurate answer (Occam's razor). If the Fed's ultimate goal is to boost demand in the economy and not concerned about other political objectives, direct transfers to the people are the most optimal approach rather than relying on an economic theory that sounds good but proves to be just a "theory" in reality.

The unexpected Covid pandemic has completely changed the economic landscape that the Fed and the financial world have become accustomed to. The era of cheap money has ended, and the era of high-interest rates has opened a new chapter in the Fed's management era. The Fed is struggling with time to deal with the unintended consequences of strong interventions in a complex system where interactions between nodes are completely uncertain. The Fed was forced to provide free money to the people when the world economy had to halt, and also to prevent a crisis similar to the 2008-2009 global financial crisis, the Fed was very aggressive in loose monetary policies, and now it is also the Fed that has to clean up the mess from its own policies.

Inflation rising too high above the 2% target has forced the Fed to take firm actions with the market to cool down inflation, and this also means, covertly, the Fed is trying to increase the number of unemployed people. After years of futile efforts to stimulate economic growth since the global financial crisis, the Fed is now getting more than it bargained for, even in its wildest dreams, and it understands that adjustments need to be made to bring the economy back to the equilibrium point it has always aimed for.

In the most ironic twist, the Fed once again has to rescue the US economy, but this time in a completely opposite direction. No one has ever said that managing the most powerful central bank in the world is an easy task.